Client Situation

•A CPG client was underperforming compared with its main competitors and suffering from stagnating sales.

•Rolling out new products had not reversed the trend of sales decline.

•The client sought answers to the following key questions:

Which consumer should they prioritize and target?

Which functional and emotive benefits did targets value the most?

Should the existing portfolio of products be expanded or curtailed?

Results

•Improved sales by 3% in pilot markets.

•Identified $120MM in currently unserved demand by competitors.

•Identified white spaces to extend brands and called out the emotive benefits that should be emphasized.

SFC VALUE-ADD

We fielded a custom survey to collect proprietary data on shopper attitudes and motivations aiming to identify where demand was headed in the category. We conducted research on the specifics of how consumers approach the purchase decision to understand their key considerations and to comprehend the process of consumption products selection.

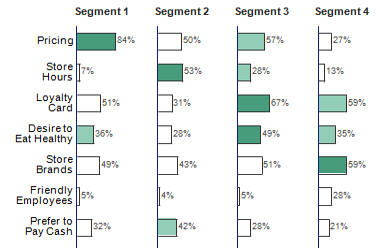

After completing data collection, we augmented the survey data with geographic sales, distribution, and logistics data. We applied data cleaning manipulations and moved on to building shopper clusters. To partition the dataset into distinct shopper groups we relied on various ensemble clustering techniques that delivered robust and stable segmentation solutions.

We considered multiple solutions with different numbers of segments. In addition to generating statistical metrics for evaluating the goodness of the resulting segments, we closely monitored outflows and inflows of segments to establish which groupings yielded maximum stability, homogeneity within segments, and distinctiveness across segments.

Linking segments with sales data allowed us to extend the segmentation framework outside of primary research. We had been able to align the existing portfolio of brands against the segments, thus linking market products to different priority targets. This uncovered white spaces ripe for product innovation amounting to $120MM in unserved demand.

Based on the mapping of existing brands to individual segments and the white space opportunities we had uncovered, we were able to carry out opportunity sizing to determine the economics associated with serving individual consumer groups. We created a demand profit framework that identified which products are generating disproportionately large or small shares of profits. Using this framework, we calculated the profit upside by segments and size the total market opportunity to evaluate ROI for various initiatives

Total sales in pilot stores improved by 3% providing strong support for national roll-out of the strategy.