Client Situation

•A property and casualty insurer had been losing some of its most profitable customers at an alarming rate.

•Broad-based retention initiatives had not stemmed attrition.

•The client sought answers to the following key questions:

Which customers have the highest risk of attrition?

Which customers that are most likely to leave for the competition are worth keeping?

What messaging should be used to prevent future outflows?

Results

•Improved retention by 7 percentage points in pilot market.

•Eliminated wasteful outbound targeting by cutting $1.2MM in ineffective marketing spend.

•Reduced external data procurement costs by $700K.

SFC VALUE-ADD

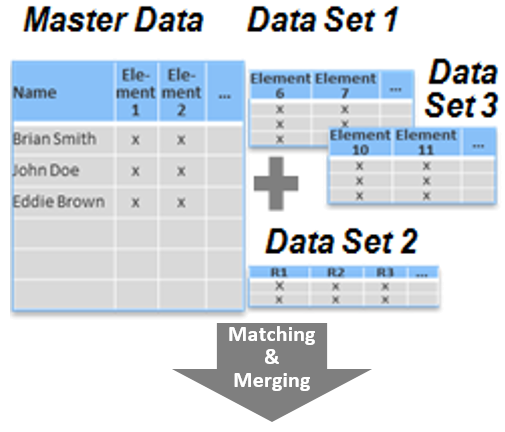

Increasing precision of outbound targeting required that we construct a comprehensive database that integrated multiple client and third-party assets. In order to construct this database, we carried out extensive data wrangling and harmonization with massive data sets.

We set up a secure cloud environment to perform all data management and modeling processes consistent with the highest compliance and security standards of the client.

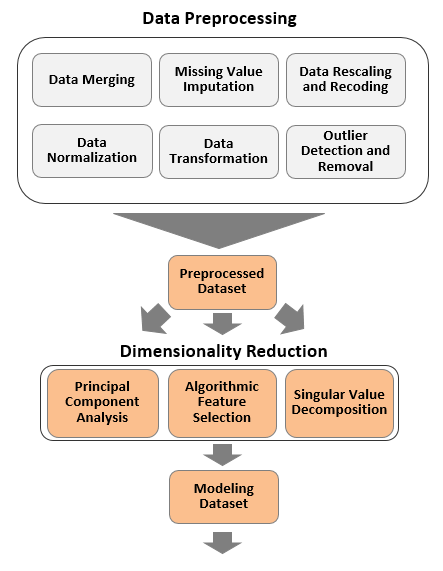

Once we built a master database comprised of disparate data sets, we relied on Machine Learning and statistical techniques to conduct data mining and manipulation. After data reshaping to fit cross-sectional and time-series requirements was completed, we applied an agile modeling approach.

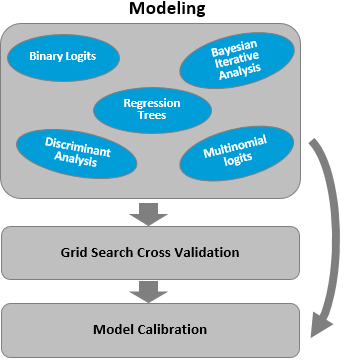

Rather than modeling at length to select the specification with best fit, which is the traditional approach to building retention models, we used our proprietary Artificial Intelligence approach that started with top-performing model in the hold-out sample. Then, to harness the power of continuous behavioral and transaction data collection, e.g., claims, new products, policy renewals, etc. , we ran the model monthly and evaluate performance against observable attrition, re-estimating and re-calibrating the model for optimal performance.

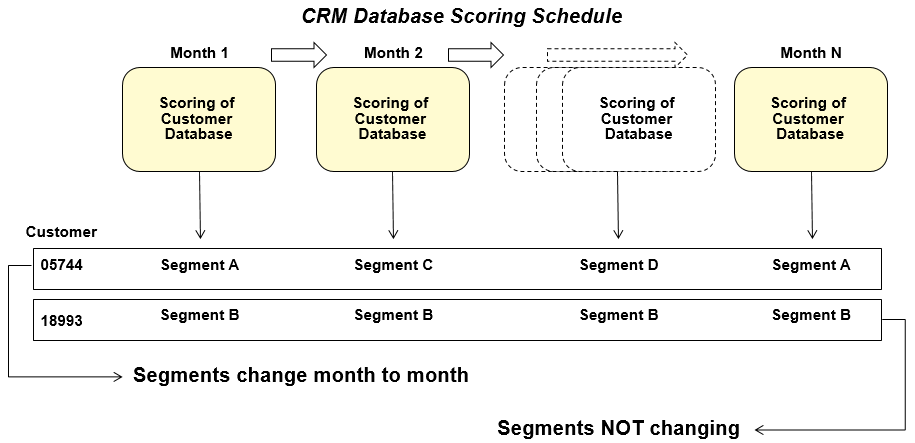

Our model implementation architecture was dynamic for on-going scoring of client's CRM database. Repeated scoring of the CRM database allowed us to incorporate a dynamic aspect into the segment. Segment habituation would be instrumental in creating customer score cards for dynamic monitoring of attrition risk.

The dynamic nature of our segment assignments allowed us to create a retention score that reflected the history of agent actions. Furthermore, we were able to continuously fine-tune modeled risk of attrition at various points of time.

The customer defection model we implemented offered a high degree of precision in predicting churn. These predictions yielded a highly accurate and comprehensive view of the customer book of business for our client which allowed us to cut $1.2 Million in wasteful outbound marketing spend.